Aetna Funding Advantage

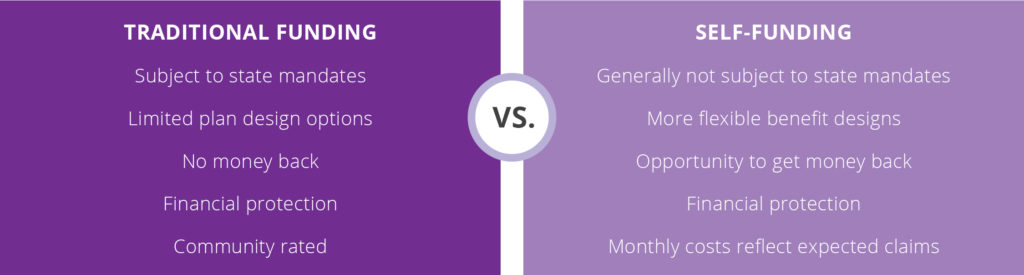

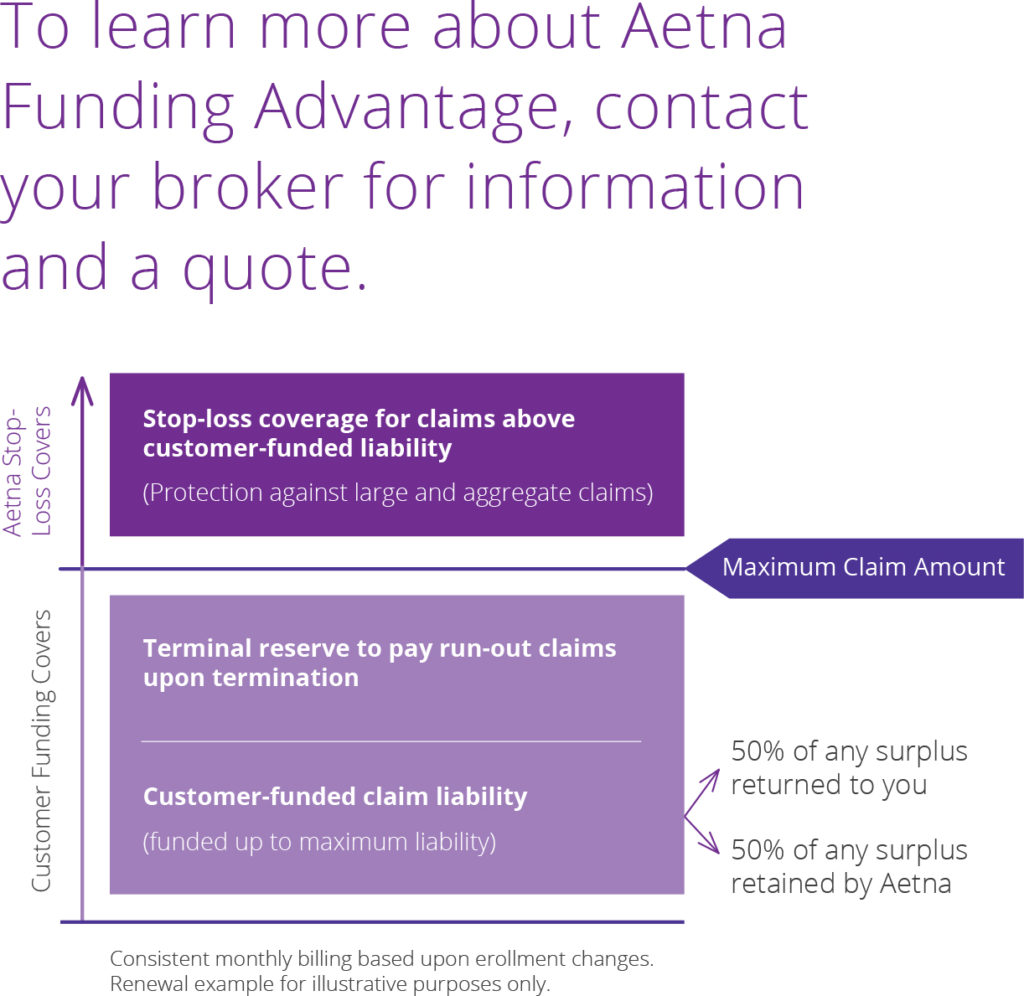

The Aetna Funding Advantage health plan provides the benefits of self-funding that are traditionally offered to larger companies, but are specifically designed to be attractive and affordable for small businesses like yours. A key benefit of Aetna Funding Advantage is the opportunity for cost savings through our unique funding structure that returns 50 percent of any surplus at the end of the year to you, when you renew your plan. There are also options to pay higher monthly amounts in return for getting back claims surpluses at termination. In addition to a potential surplus, Aetna Funding Advantage provides protection against claims that are higher than anticipated through stop loss insurance. It’s all about cost savings without the risk. So, let’s talk about finances — how does Aetna Funding Advantage work?

Total Costs

With Aetna Funding Advantage, you make a single monthly payment that remains stable throughout the year. This payment covers your claims funding, terminal reserve, stop loss premium and administrative fee.

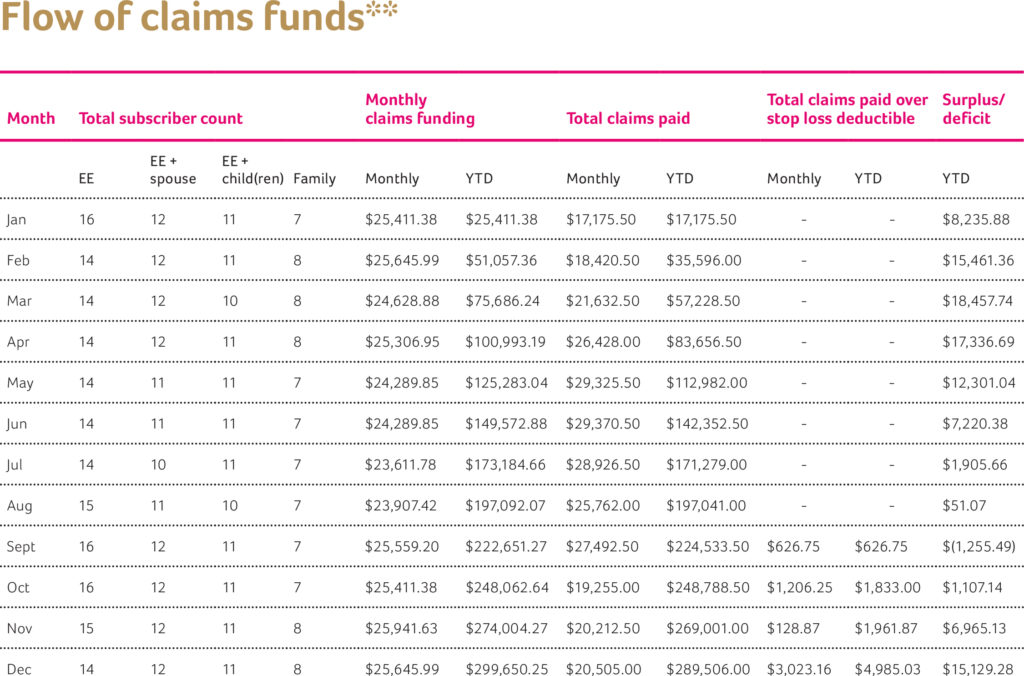

Below is an example of how the funding and flow of dollars for Aetna Funding Advantage work for a full year. You will see there are instances of both surpluses and deficits — we talk about those in more detail in the year-end accounting section. Remember, when claims are higher than anticipated, you are protected by your stop loss insurance.

*Funds your maximum claims amount. Each month, the number of enrolled employees is used to determine the maximum claims amount.

Aetna is the brand name used for products and services provided by one or more of the Aetna group of subsidiary companies, including Aetna Life Insurance Company and its affiliates (Aetna).

For self-funded accounts, benefits coverage is offered by your employer, with administrative services only provided by Aetna Life Insurance Company (Aetna).

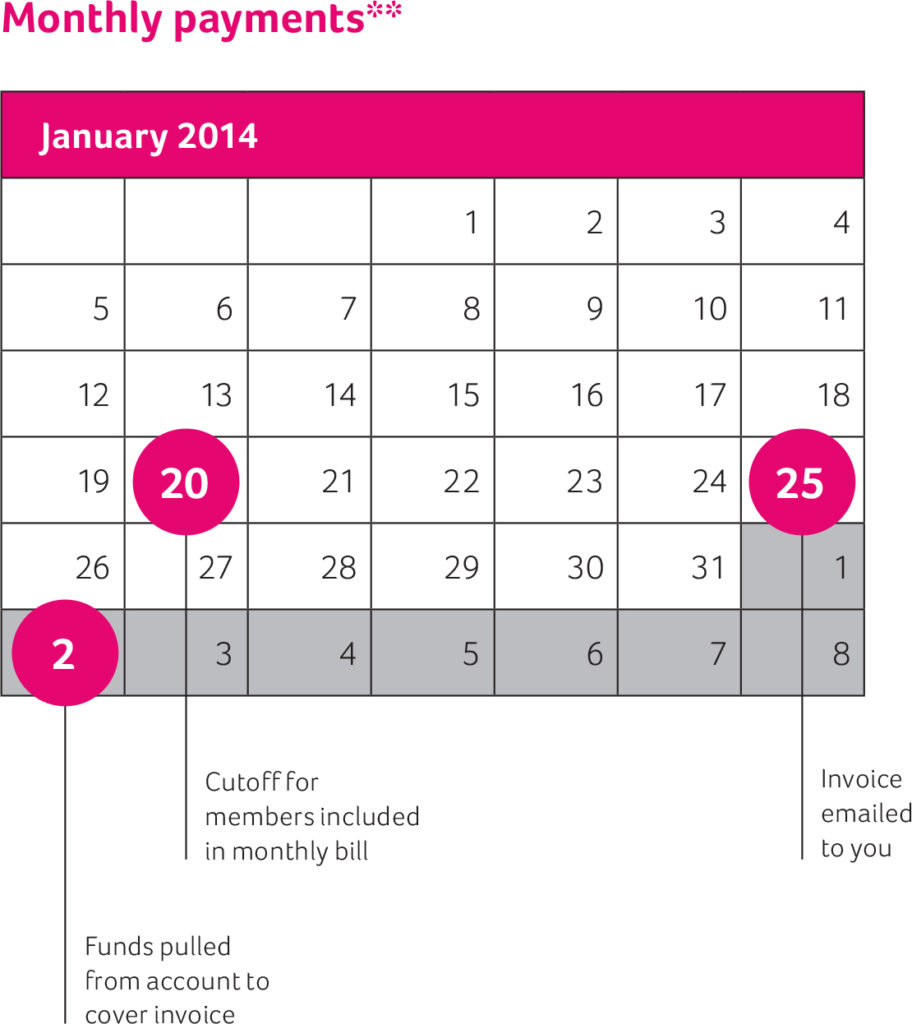

Billing

To simplify the billing and payment process, Aetna Funding Advantage works by pulling your monthly payment from the bank account you have defined for Aetna during the enrollment process. Your Aetna representative will provide a monthly billing summary prior to the first month’s pull of funds based on your enrollment. It is important to note that the first month’s pull of funds will occur during the first week of the following month. The second month’s billing summary will take into account any changes that may have occurred based on final enrollment.

The number of members enrolled as of the 20th of the month will be used to generate your monthly payment. And an invoice will be emailed to you on the 25th of that month. The second business day of the next month, Aetna will pull funds from your account to cover your monthly invoice.

**Illustrative content only.

***Subject to change.

Reporting

Built-in transparency

In addition to providing financial protection, predictability and potential cost savings, Aetna Funding Advantage offers transparency through reporting. To help you keep track of claims activity and funding, we provide three regular reports:

1. Enrollment Report — tracks enrollment by plan type and is included with your monthly invoice

2. Fund Summary — shows funding levels and total claims and is sent to you monthly

3. Large Claimant Report — shows de-identified members who are running $15,000 or higher throughout the year (provided at renewal)

Three ways you could save

1. Tax savings — Aetna Funding Advantage is exempt from the health insurance providers fee. In addition, Aetna Funding Advantage plans generally are not subject to state premium taxes.

2. Surplus — With Aetna Funding Advantage, if you renew your plan and your total claims during the plan year are lower than expected, you get money back. There are also options to pay higher monthly amounts in return for getting back claims surpluses at termination.

3. Benefits design — Aetna Funding Advantage is not subject to benefits design mandates, allowing for less costly benefits levels.

*Illustrative content only.

This material is for informational purposes only and is neither an offer of coverage nor medical advice. It contains only a partial, general description of programs and services and does not constitute a contract. Aetna is not a provider of health care services and, therefore, cannot guarantee any results or outcomes. All participating providers are independent contractors and are neither agents nor employees of Aetna.

Year-end accounting

Year-end is the opportunity for Aetna to provide you with money back if you run a surplus in claims funding. To determine if you have a surplus at the end of the year, we will subtract the annual total claims paid from the annual total monthly claims funding collected to determine if there is money left over once claims are paid. The terminal reserve has been prefunded throughout the year and is not included in the surplus calculation. The terminal reserve is used to pay claims upon termination. Once the claims are paid, any remaining dollars are considered a surplus.

If you renew your plan, any surplus in claims funds will be returned after the contract ends (less a 50 percent deferred administration fee). There are also options to pay higher monthly amounts in return for getting back claims surpluses at termination.

Don’t worry if you have a deficit at year-end. If an individual’s claims exceed the specific stop loss deductible, Aetna, as the stop loss carrier, will pay any additional covered benefits accumulated by that member. Also, if the total group’s total claims exceed the annual claims funding, Aetna will pay the remaining covered benefits in accordance with your stop loss policy. A deficit will never carry over to the next year.

Surpluses and deficits*

Total claims funding $300,000

Annual claims paid – $250,000

Result = $50,000 surplus

50% returned to you

50% retained by Aetna

Discover the many ways that Aetna Funding Advantage can help your business save

Tired of rising health care costs? Switching to a self-funded plan may be easier than you think. It’s time to consider Aetna Funding Advantage.

The Advantage opportunity

Self-funded plans are more stable. Monthly payments are based on the health trends of your employees. And when health care costs are lower than expected, you get back a percentage of your funds. Control your health care costs with Aetna Funding Advantage, a self-funded plan backed by the strength of Aetna.

Savings and much more

Not long ago self-funded plans were only considered by larger companies. Then Aetna designed their self-funded plan with your smaller business in mind. It’s time you enjoyed these savings:

- You could save up to 25 percent upfront

- You could save long-term with the surplus sharing benefit

- You could save on taxes and fees

- You could save time on health care tracking and reporting

Is self-funding right for your company?

Typically, self-funding has been used by large companies to control benefits costs. Aetna Funding Advantage offers self-funding built for your smaller business.

It’s a win-win

With Aetna Funding Advantage, you can get money back in years when your medical costs are lower than anticipated. If medical costs are higher than anticipated, you’re protected with stop-loss insurance. And, our plan designs provide you with access to Aetna’s quality network and health and wellness benefits.

How Aetna Funding Advantage works

Rather than prefunding the cost of insurance every month, you fund a personalized maximum claim amount. When your claims are higher than this maximum amount … stop-loss insurance kicks in. And, when you renew your plan, 50% of any surplus at the end of the year is returned to you.

Explore opportunities for savings

Aetna can help you find the right coverage for the right cost. And that can make a difference for the health of your employees and the health of your company’s bottom line. Talk to your broker about Aetna Funding Advantage and put the experience of Aetna to work for you.

Talk to your broker or Aetna representative today to learn more about Aetna Funding Advantage.

Aetna Funding Advantage

To help small businesses in search of cost-saving health coverage options, the Southern Ohio Chamber Alliance (SOCA) has taken action. SOCA has created a health program that can lead to more rate stability and is a smart solution that offers potential savings for groups with 50 or fewer employees. SOCA has teamed up with Anthem Blue Cross and Blue Shield to administer this plan and to provide stop loss coverage.

This self-funded medical offering, the SOCA Benefit Plan, is a multiple employer welfare arrangement (MEWA). MEWAs enable smaller employers to join together to share in the overall claims risk. By being part of a larger, self-funded pool, employers have financial protection backed by Anthem’s stop loss coverage.

In addition to financial protection, this innovative alternative offers:

- Competitive rates

- Fixed, predictable monthly payments

- A variety of plan designs

- Anthem’s broad Blue Access PPO Network and Essential Rx Formulary

- Coverage for claims run-out /terminal liability coverage

To top it off, we’ve added expanded wellness offerings so your employees can benefit from your investment in them even more. And we also offer ancillary products that are only available to employers participating in the SOCA Benefit Plan, including dental, vision, life, optional life, and disability plans at specially discounted rates.

Who is eligible for the SOCA Benefit Plan?

The SOCA Benefit Plan is available to small business employers that have at least two employees enrolled on their medical plan and no more than 50 total employees. The business must be domiciled in Ohio, and must be a member in good standing with a Chamber of Commerce that is qualified to offer the SOCA Benefit Plan. These chambers include:

- Southern Ohio Chamber Alliance (SOCA)

- Northern Ohio Area Chambers of Commerce (NOACC)

- Central Ohio Chambers of Commerce (COCC)

- Dayton Area Chamber of Commerce (DACC)

- Youngstown/Warren Regional Chamber (YWRC)

We’ve got you covered with exceptional health and wellness programs.

24/7 NurseLine: Toll-free 24/7 phone support to give your employees round-the-clock answers to health questions.

Autism Spectrum Disorder Program: Helps connect your employees with licensed behavioral analysts who work with children on the spectrum.

Behavioral Health: Your employees’ emotional well-being is as important as their physical well-being to your organization’s ability to stay competitive. Employees who are dealing with depression, anxiety, stress or substance abuse need help. Our Behavioral Health program is integrated with our health plans and includes our extensive network of psychiatrists, social workers and residential treatment centers.

Case Management: Following a major hospitalization, your employees may feel overwhelmed about how to get back to work and life. That’s where our nurse care managers come in. These nurses can help coordinate discharge instructions, follow-up care and in-home health care arrangements.

ComplexCare: This program identifies, engages and supports employees and their covered dependents living with one or more complex health issues that could lead to costly, long-term care. The program can help your employees manage their conditions and improve their quality of life. Employees also get 24-hour, toll-free access to nurse care managers who can answer health-related questions and offer health tips. Plus, the nurse care manager can coordinate care between doctors and other health services to help employees reach their personal health goals.

ConditionCare: This program identifies, engages and supports employees and their covered dependents living with one or more chronic conditions, including asthma, diabetes, coronary artery disease, heart failure and chronic obstructive pulmonary disease (COPD). Participants have access to a nurse care manager and team of specialists who work to help them better understand their condition and follow a doctor’s care plan. ConditionCare nurses use information from employees and their doctors to create a personalized plan for better health, and delivers a return on investment of at least 2:1.

ConditionCare End-Stage Renal Disease (ESRD): This care management program for employees who have end-stage renal disease aims to lower health care costs by helping employees follow their doctor’s care plans and prevent hospitalizations. Employees are assigned a primary nurse care manager to educate them about their condition and guide them throughout the therapy process. Our experienced nurse care managers can also connect employees with appropriate caregivers, such as social workers and nutritionists specializing in ESRD.

Future Moms: Offers education and support to help your employees have a healthy pregnancy. Moms-to-be get assessments to help spot risks, and are mailed educational materials and tools to help them track their pregnancy. A team of OB/GYN nurses and specialists follow up throughout the pregnancy to make sure moms-to-be are making healthy decisions and following their doctor’s care plan. Expecting moms can also call their team of nurses for support or to ask questions during the pregnancy and after delivery. Taking part in the program may result in lower medical costs for both mother and baby. According to a recent study, Future Momsparticipants have:

- 30% fewer emergency room visits than those not in the program.

- Babies who spend 25% less time in the neonatal intensive care unit (NICU), leading to a 50% reduction in NICU costs.

MyHealth Advantage: MyHealth Advantage reviews your employees’ claims foropportunities to improve care, reduce health risks and savemoney. When gaps or risks are identified, we mail aconfidential MyHealth Note to the employee outliningspecific actions he or she can take for better health and lower health care costs. The note may point out potential drug interactions, remind the employee about important doctor’s appointments or recommend health checkups and screenings. MyHealth Notes can also be viewed in the Secure Message Center on anthem.com and the Anthem Anywhere app. This program has a return on investment of 1.63:1. And 46% of participants who received a MyHealth Note came back into clinical compliance.

Online Wellness Toolkit: This set of tools can help your employees set and achieve their unique health goals. The web-based toolkit includes:

- A Health Assessment for identifying health risks

- Guidance for lowering those risks

- Personalized trackers to monitor employees progress

- Fun activities that promote healthier decision-making

Find out more today.

To learn more about the SOCA Benefit Plan’s many advantages, call 1-844-MED-OHIO or visit 844MedOhio.com, or ask your Chamber of Commerce for a referral to a participating broker.

Be sure to ask about special discounts on dental, vision, life and disability coverage available through the SOCA Benefit Plan.

Employer FAQ

What is a MEWA?

A MEWA is a multiple employer welfare arrangement. It is an employee welfare benefit plan, trust or other arrangement that is established or maintained for the purpose of offering group insurance. It is governed by

Trustees and By-Laws that satisfy the Ohio Department of Insurance (ODI) requirements.

How will the SOCA Benefit Plan pay our employees’ claims? Will they have the funds necessary?

The initial capital requirement of $500,000 has been satisfied. The ODI increased this requirement from

$150,000 with the objective to protect consumers. There is quarterly adequate risk based capital monitoring by the ODI of the Plan. In addition, Anthem is providing additional reinsurance protection under a quota share arrangement on top of the specific and aggregate stop loss coverage provided.

Who makes the decisions for the SOCA Benefit Plan?

The SOCA Benefit Plan Board of Trustees will be responsible for the oversight of the Plan and ensuring that the Plan complies with all applicable laws and regulations.

Why would we choose a MEWA over an ACA policy?

This alternative self-funded solution could be a good fit for you for many reasons including:

- Competitive rates

- Rating methodology similar to pre-ACA rating

- Predictable, fixed monthly payments

- Protection of being part of a larger self-funded pool backed by Anthem’s stop loss

- Anthem’s broad Blue Access PPO network

- Flexibility in choice of benefit plans

How do we determine if we are eligible to participate? The SOCA Benefit Plan is available to small business employers that have at least two employees enrolled on their medical plan and no more than an average of 50 total employees. The business must be domiciled in Ohio and must be a member in good standing with a Chamber of Commerce that is qualified to offer the SOCA Benefit Plan. These chambers include:

- Southern Ohio Chamber Alliance (SOCA)

- Northern Ohio Area Chambers of Commerce (NOACC)

- Central Ohio Chambers of Commerce (COCC)

- Dayton Area Chamber of Commerce (DACC)

- Youngstown/Warren Regional Chamber (YWRC)

Do we need to meet certain participation and contribution requirements? Yes. At least 75% of the Net Eligible Employees and a minimum of two employees must be covered under the Plan. The minimum employer contribution is at least 25% of the total cost for health benefits chosen in the event the employee has dependent benefits, and at least 50% of the total cost for health benefits in the event the employee has single benefits. If you contribute 100% of the premium equivalent, 100% of the net eligible employees must enroll.

Can we join the SOCA Benefit Plan at any time during the year? Yes, however, all participating employers in the SOCA Benefit Plan renew on May 1 of every year.

How will my premium equivalent rate be determined? There are multiple factors that impact your premium equivalent rate including:

- Medical history and expected risk of your employees’ future health claims

- Age and gender of your employees

- The number of employees enrolled on the benefit plan

- Where your company is located

- Benefits that are being offered

What components are included in my premium equivalent rate? Are there other amounts that we have to pay in addition to the premium equivalent rate? Your premium equivalent rate covers expected claims, administrative expenses, taxes and assessments, and stop loss premium. In addition, chamber membership dues and product dues are required to be paid. These amounts are paid to the chamber that you are a member of and the SOCA Benefit Plan, respectively.

How will the annual renewal increase be determined? An overall renewal increase needed for the SOCA Benefit Plan will be calculated based on a projection of the claims for the upcoming policy year for the entire SOCA Benefit Plan. Each participating employer’s increase will then be calculated based on that employer’s specific claims history and risk profile, as well as any changes in the demographics and number of enrolled employees of the group.

Can we terminate our policy at any time? During the policy period, you may only elect to withdraw from the MEWA as of the end of a calendar month by giving written notice at least 60 days prior to that date. At renewal time, you must give written notice at least 30 days in advance.

We currently have an Anthem Blue Cross and Blue Shield policy. Will our employees have to change their doctor? The SOCA Benefit Plan uses Anthem Blue Cross and Blue Shield’s Blue Access health care provider network – one of the largest networks in the state. (It’s always wise to make sure doctors are in-network prior to any service using the “Find a Doctor” tool on anthem.com.)

Are dental, vision, life and disability options available? Yes, participating employers in the SOCA Benefit Plan are eligible for discounted ancillary plans offered by Anthem. This includes dental, vision, life and disability. These are stand-alone, fully insured plans for which the participating employer contracts directly with Anthem.